IRA Donations

Donating an IRA to a charity benefits both donors and nonprofits.

Such donations are tax-deductible since charities are exempt from income taxes, avoiding taxation on the received distributions.

Contributing unused retirement assets, like an IRA, is a valuable way to support charities such as the GOSUMEC Foundation USA.

Why Donate IRA?

Is donating an IRA to charity tax deductible?

Donating an IRA to a charity benefits both donors and nonprofits.

Such donations are tax-deductible since charities are exempt from income taxes, avoiding taxation on the received distributions.

Contributing unused retirement assets, like an IRA, is a valuable way to support charities such as the GOSUMEC Foundation USA.

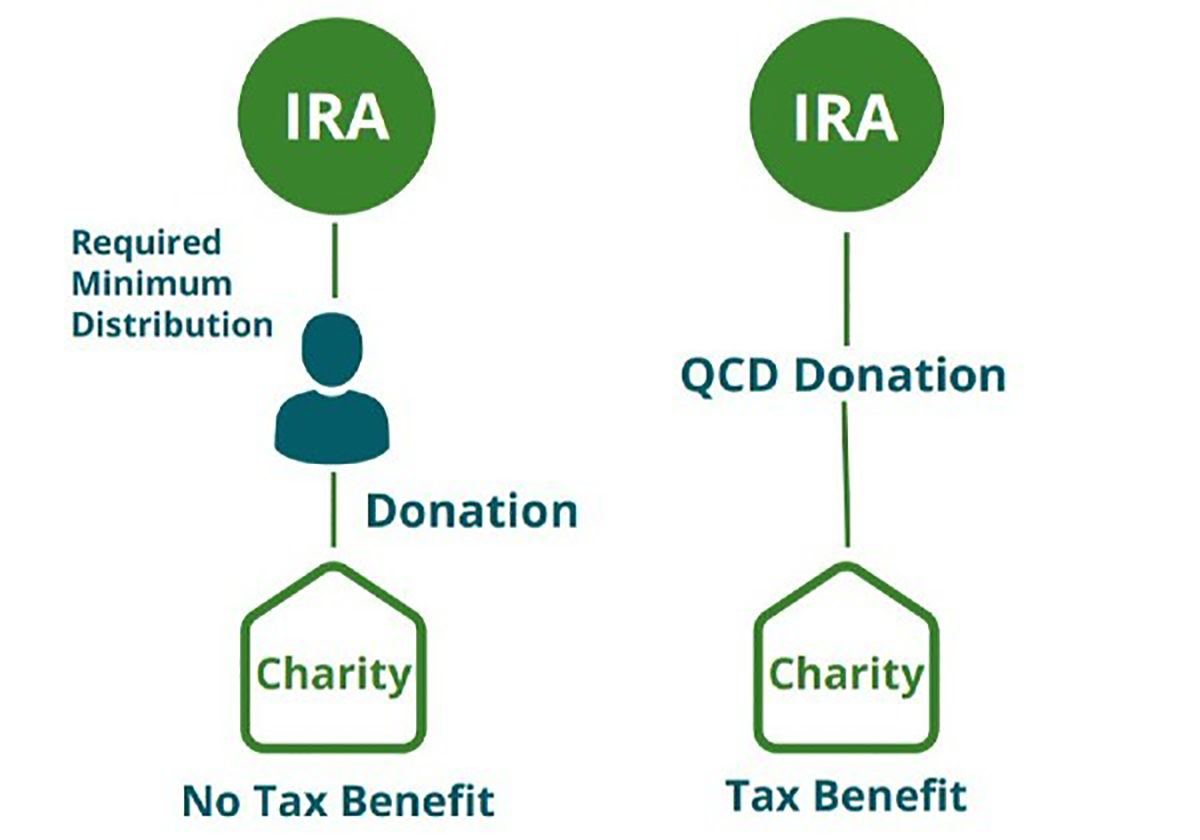

How does a qualified charitable distribution (QCD) or charitable IRA rollover work?

If you’re over 70½, you can gift up to $105,000 annually from your IRA directly to a qualified charity, like GOSUMEC Foundation USA, making it tax-free.

This contribution counts towards your required minimum distribution without adding taxable income.

The deduction reduces your adjusted gross income, and the QCD mandates a direct transfer from a traditional IRA to a qualified public charity during the relevant tax year.

Can an IRA donation count for my RMD?

QCD:

Certainly, opting for a tax-free donation through a QCD directly to GOSUMEC Foundation USA or another eligible charity fulfills your RMD.

A QCD, by reducing your Adjusted Gross Income (AGI), offers tax deductions and the possibility of saving on surcharges.

- Initiate this process in the year you’re obligated to take distributions, using the gift to fulfill all or part of your RMD.

- Simply reach out to your IRA administrator to facilitate the QCD.

- Download a sample Letter of Instruction to get started gifting to GOSUMEC Foundation USA.

Donating to charity after receiving your RMD might not yield tax benefits if you claim standard deductions.

GOSUMEC Foundation USA must receive your gift by Dec. 31 for your IRA charitable distribution to qualify for that tax year.

Disclaimer: GOSUMEC Foundation USA does not offer tax, legal, or accounting advice. This information is provided for informational purposes only and should not be relied upon for such advice. Consult a tax professional for personalized guidance on potential tax benefits related to charitable gifts.