Donate Now

Support GOSUMEC Foundation USA

GOSUMEC Foundation USA, a 501(c)(3) not-for-profit organization, invites your generous support.

Tax Information

- Tax ID: 92-1826702

- Donations to GOSUMEC Foundation USA are tax-exempt, as permitted by law.

Zero Overhead

GOSUMEC Foundation USA is proud to confirm that we operate as a zero-overhead non-profit organization.

Operating expenses are covered separately from foundation donations, ensuring that 100% of your contributions directly support the cause.

This recognition reflects our strong commitment to transparency.

By regularly updating our GuideStar Nonprofit Profile, we share comprehensive metrics on our progress, impact, and organizational details, demonstrating our dedication to openness and providing valuable data for evaluation.

Is my donation secure?

We partner with Stripe, the industry’s established payment processor trusted by some of the world’s largest companies.

Your sensitive financial information never touches our servers. We send all data directly to Stripe’s PCI-compliant servers through SSL.

Is this donation tax-deductible?

How do I avoid transaction charges?

To avoid transaction charges, we recommend:

- Zelle transfers

- Donor Advised Funds

- Mail a check

How do I get the donation receipt?

For any inquiries, feel free to contact founder@gosumec.org or treasurer@gosumec.org.

Zelle Enrollment and Donation

1. Enroll in Zelle

Use your mobile banking or the Zelle app. Zelle has no fees, but check your bank’s transfer limits.

2. Send Donation

Enter treasurer@gosumec.org as the recipient. Add the amount. GOSUMEC Foundation USA will be notified.

3. Receipt Confirmation

Email your name, address, and donation amount to treasurer@gosumec.org. We’ll promptly issue a receipt.

Donate Stock

Amplify Tax Benefits by donating appreciated stocks with Embedded Capital Gains, saving you money while supporting GOSUMEC Foundation USA.

Your contribution goes further, amplifying the impact on our mission to support Student Scholarships .

How Do I Donate Appreciated Securities?

The process is simple!

Share the stock name, number of shares, and GOSUMEC Foundation USA account details with your stockbroker:

- Financial Institution: Charles Schwab

- Account Registration: GOSUMEC FOUNDATION USA

- Account Number: 5772-1426

- DTC Number: 0164

Then, email founder@gosumec.org to confirm your completed order, including your name, contact information, brokerage institution, stock name, number of shares and date of transaction.

Important Notes:

This information does not constitute legal or tax advice; consult your financial advisor.

GOSUMEC Foundation USA may sell the securities post-transfer.

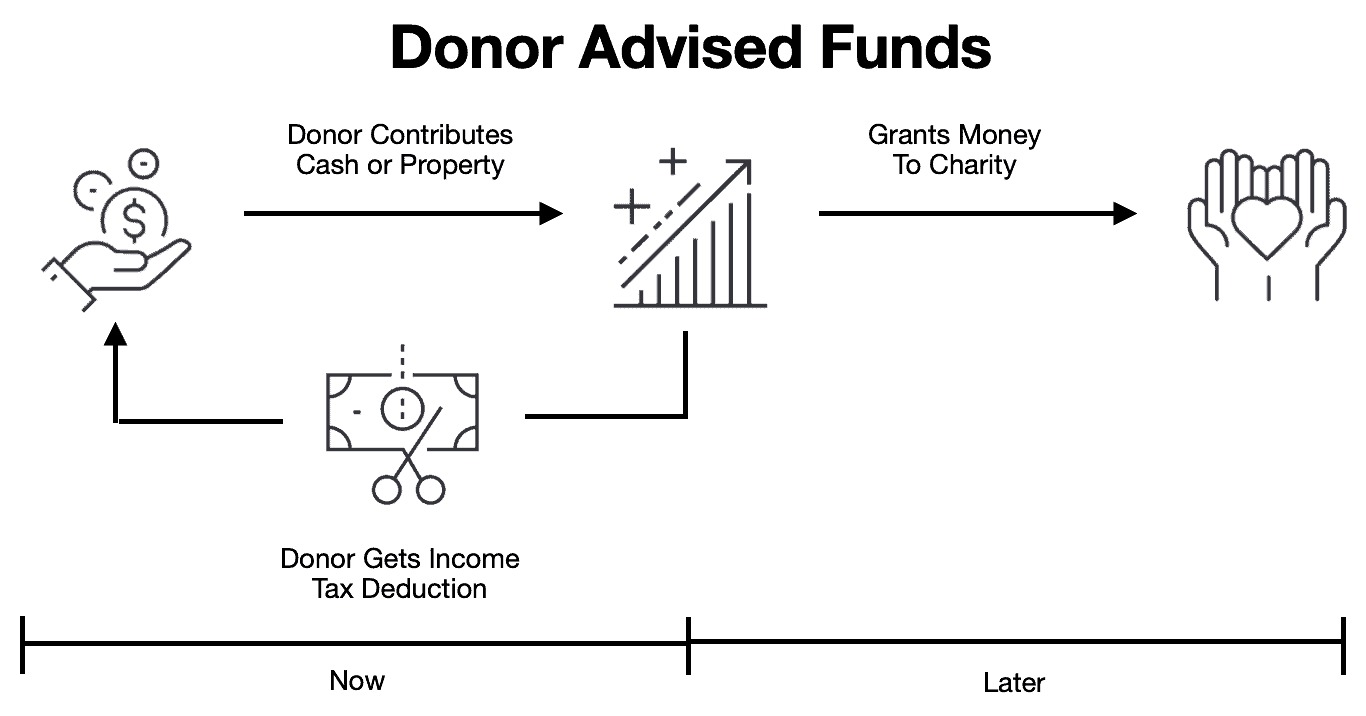

The Donor Advised Fund (DAF) lets individuals consolidate contributions and itemize deductions, aligning philanthropy with financial planning.

This tax-efficient strategy, combined with Roth conversion, not only enhances lifetime giving through tax-free growth but also supports prudent financial planning.

Recommend a grant through your fund administrator. Our EIN 92-1826702

Clients of Fidelity Charitable, Schwab Charitable and BNY Mellon can make a designation through the DAF Direct window above.

Donor-Advised Fund (DAF) sponsors like Vanguard Charitable can now efficiently and electronically grant funds to us through PayPal.

We are a qualified charity with Fidelity Charitable Gift Fund EFT and PayPal Giving Fund.

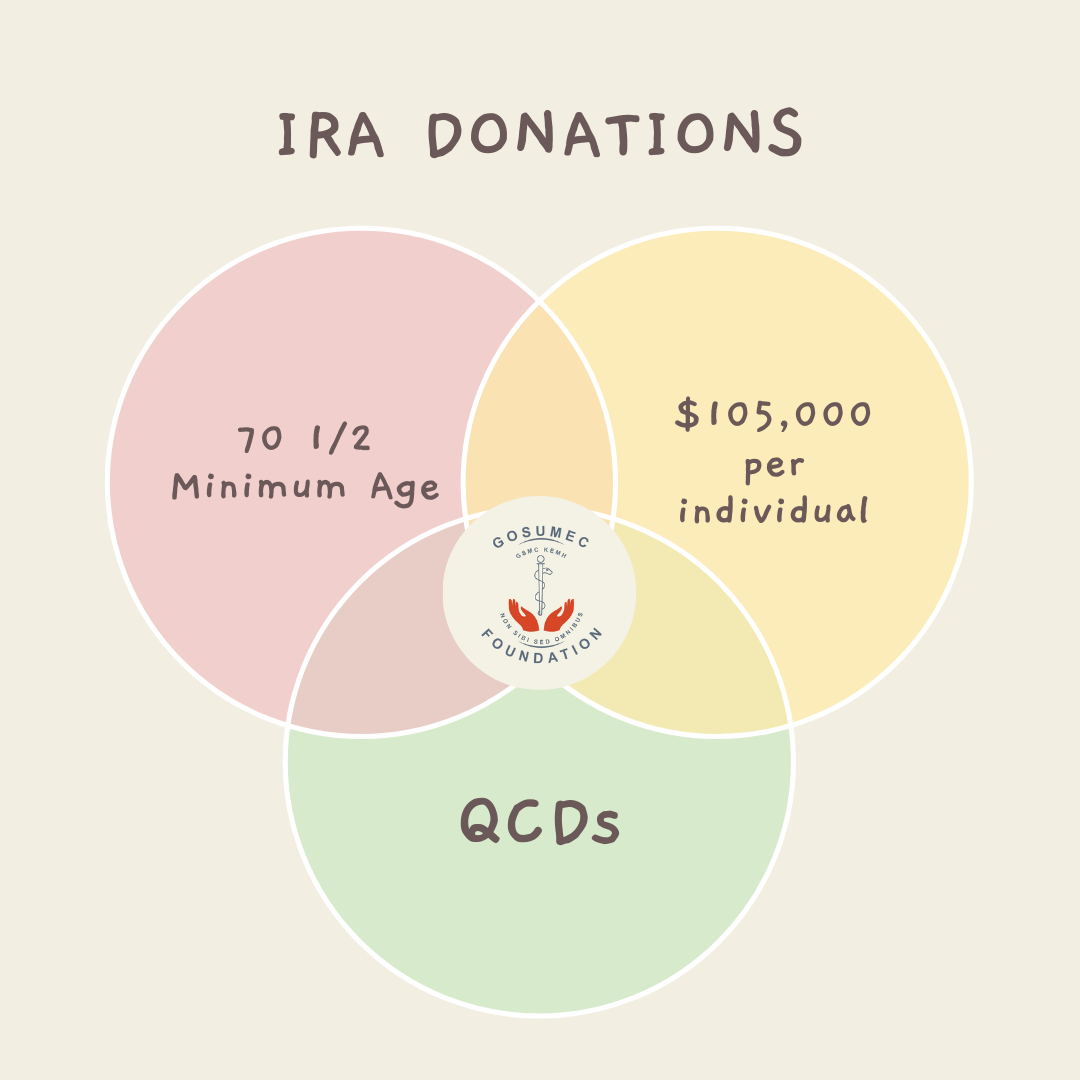

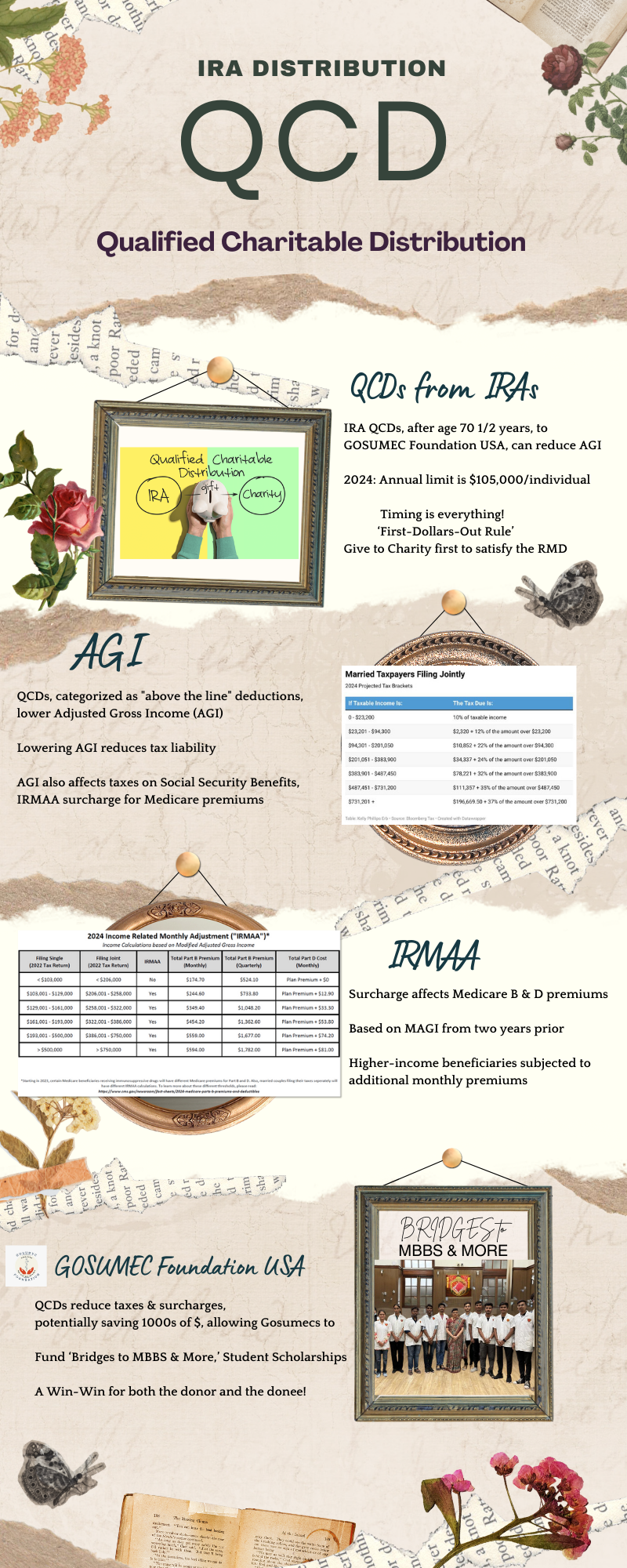

Strategic Donations from IRA

Donating retirement assets, like an IRA, provides crucial support to charities such as the GOSUMEC Foundation USA.

Your contribution can make a meaningful impact on our mission and initiatives.

Efficient Charitable Giving

Individuals aged 70½ or older can donate up to $105,000 directly to charities from an IRA through a QCD.

This can be done potentially before the mandatory RMD starting at age 73, allowing individuals to enhance their charitable legacy.

QCD: Qualified Charitable Distribution

RMD: Required Minimum Distribution

AGI: Adjusted Gross Income

IRMAA: Income Related Monthly Adjustment

We’ve partnered with Charitable Adult Rides and Services (CARS) to make it easy! Click the secure donation links or call to register your vehicle.

Select GOSUMEC Foundation USA as your charity of choice. CARS will take care of pick up, sale, donation receipt, tax documents and payments to GOSUMEC Foundation USA.

Call CARS to Donate

Check or Wire

Please make check payable to:

GOSUMEC Foundation USA

Please include your email address, so we can issue a receipt.

Mailing Address:

GOSUMEC Foundation USA

177 Telles Ln, Fremont CA 94539

To wire funds from your bank, please contact founder@gosumec.org or treasurer@gosumec.org for assistance.

Employer Matching

Many employers will match charitable contributions made by their employees, employee spouses or retirees.

Benevity

We’re registered with Benevity and eligible for Corporate Matching Gift Programs.

To ascertain if your employer provides a donation matching program, search Double the Donation with your employer’s name.

Match

This will help you determine whether they offer a donation match, as well as the specific match amounts and match ratio.

It’s an easy way to double your contribution to GOSUMEC Foundation USA!