DAF Donations

Donor Advised Fund

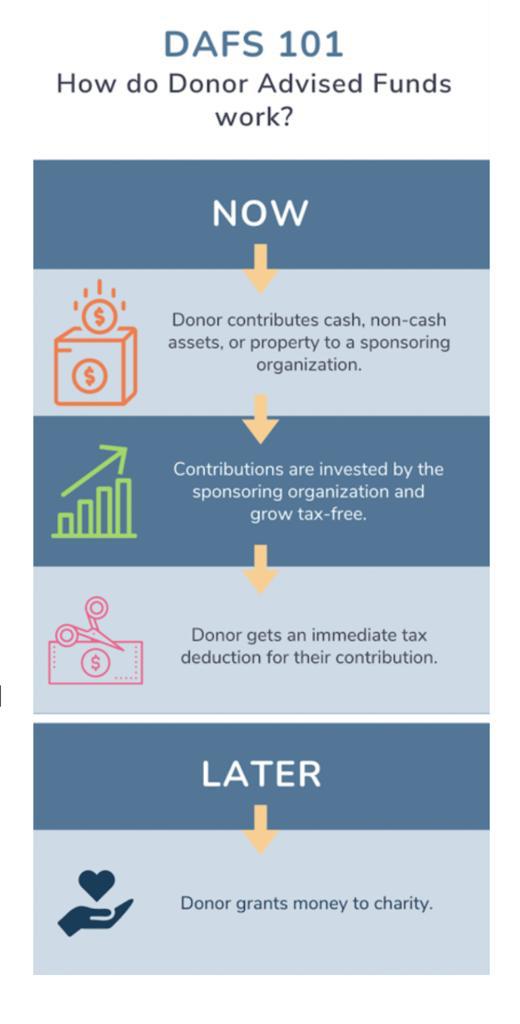

A donor-advised fund (DAF) allows for immediate tax deductions on charitable donations

DAFs let donors contribute assets now and decide when to grant funds to the charity later

During this period, assets within the DAF also experience tax-free growth

How do DAFs work?

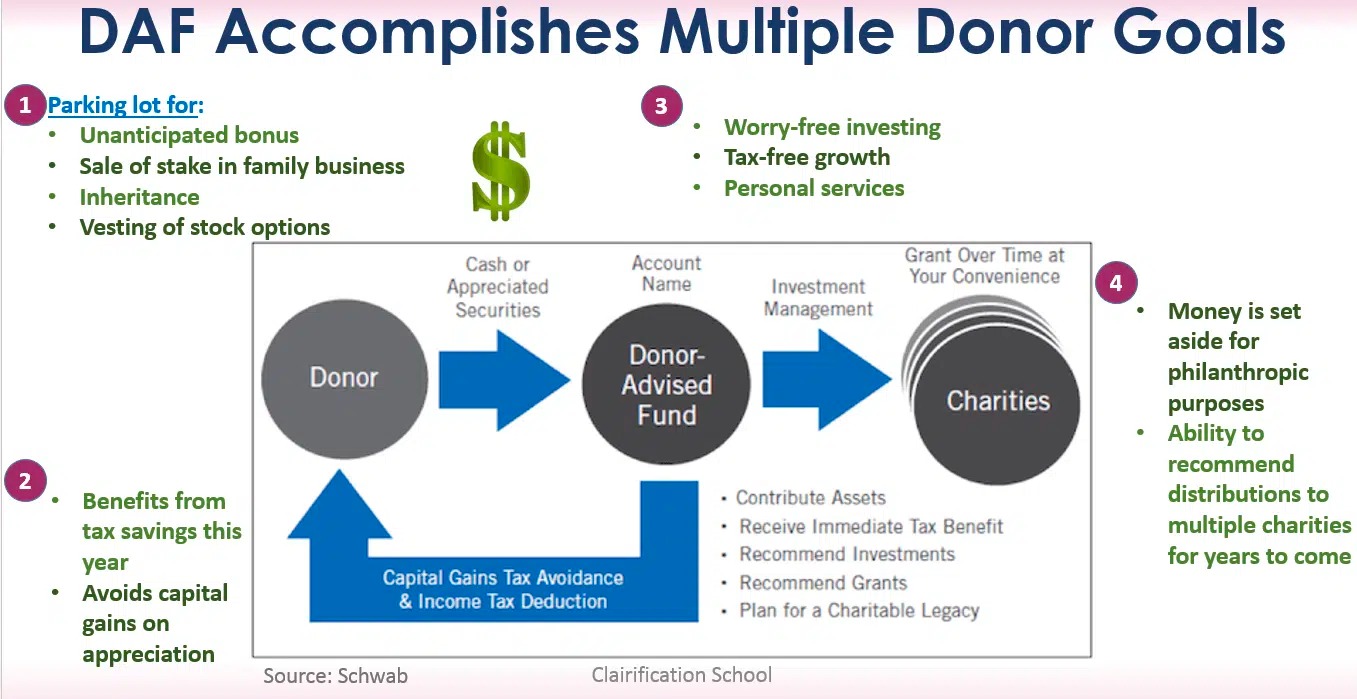

A donor-advised fund offers strategic advantages for timing charitable contributions in high-income years

Front-loading contributions in high income years allows to optimize deduction benefits

DAFs empower individuals to optimize deductions, facilitating itemization on Schedule A

Advantages of DAF

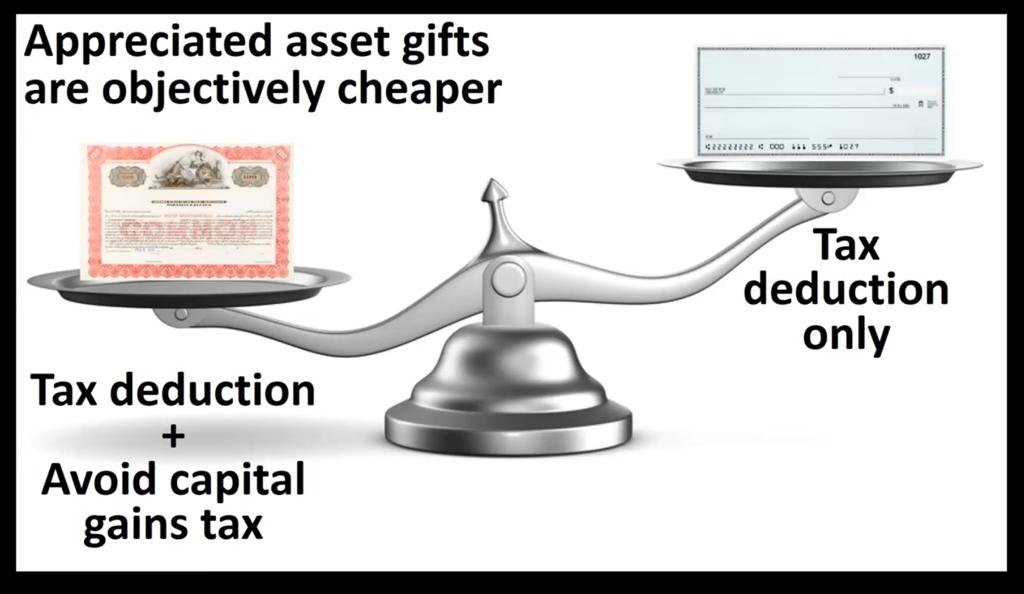

DAFs enable donation of appreciated investments, qualifying for a charitable deduction and effectively eliminating embedded capital gains

DAFs simplify the contribution and liquidation of diverse investment assets beyond marketable securities

Charitable Legacy

DAFs enable legacy giving, facilitating the transition of assets and mitigating estate taxes beyond pass-on limits

DAFs create a lasting charitable legacy for future generations